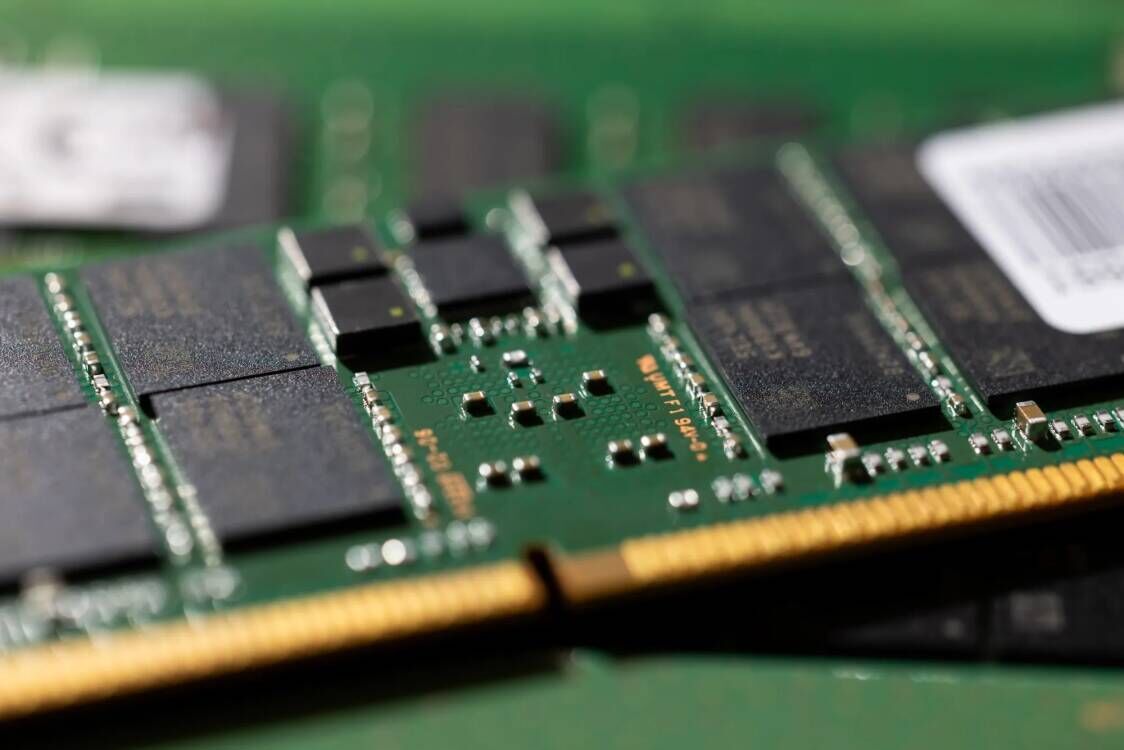

May 27, 2025 /SemiMedia/ —NAND Flash contract prices are expected to climb 5% to 10% in the third quarter of 2025, driven by tightening supply of enterprise solid-state drives (SSD) and strong demand from cloud service providers (CSPs), according to TrendForce.

Accelerated deployment of high-end AI servers, such as NVIDIA’s GB200, along with broader enterprise IT expansion, is supporting the upswing in SSD procurement. Meanwhile, hard disk drive (HDD) orders have also increased since the start of the year, signaling robust data center investment that is likely to continue throughout 2025.

TrendForce notes that NAND suppliers adopted conservative production strategies earlier this year, helping stabilize the supply-demand balance. However, with low inventory levels and steady enterprise demand, the market now faces a tighter supply environment heading into Q3.

In contrast, retail and consumer PC demand remains soft, and early April’s geopolitical disruptions introduced short-term uncertainty. As a result, suppliers are keeping wafer input levels in check.

Despite lingering risks, the combination of constrained supply and sustained enterprise-side growth is expected to support a gradual recovery in NAND Flash pricing and broader market sentiment in the coming quarters.

All Comments (0)