May 7, 2025 /SemiMedia/ — Memory chip prices surged in April as IT hardware makers rushed to stockpile inventory ahead of potential U.S. tariffs, driving up both DRAM and NAND fixed contract prices and bolstering prospects for South Korean chipmakers.

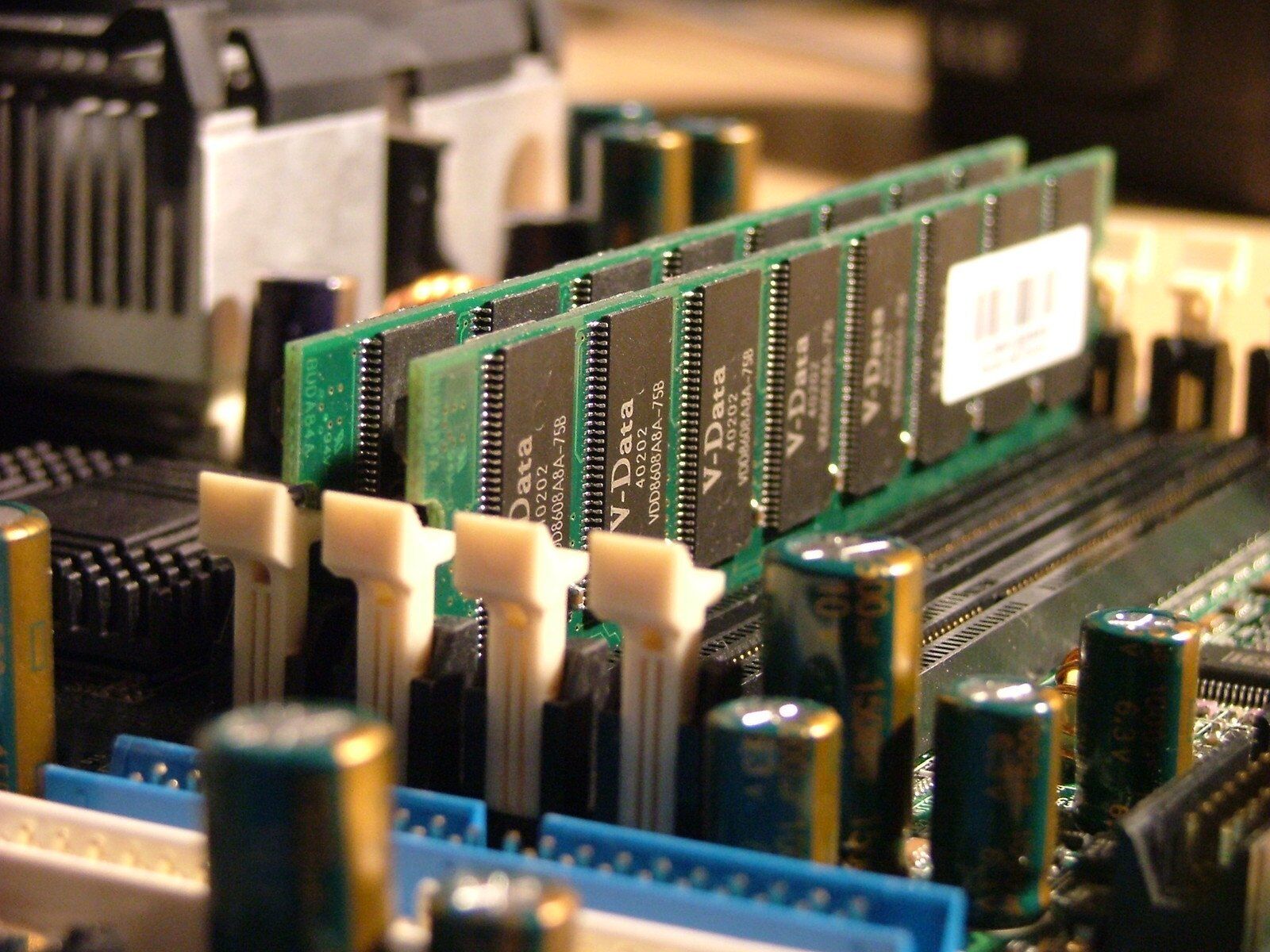

According to DRAMeXchange, the fixed price of mainstream 8Gb DDR4 DRAM, widely used in personal computers, climbed to $1.65, up 22.22% from March. Meanwhile, the 128Gb multi-level cell (MLC) NAND flash, used in USB drives and memory cards, rose 11.06% to $2.79.

Industry sources attributed the price hikes to increased procurement by major OEMs during a 90-day tariff grace period announced by the U.S. government. With inventories depleted and geopolitical uncertainties looming, demand surged across the memory sector.

Fixed pricing refers to the rates set in contracts between semiconductor suppliers—such as Samsung Electronics and SK hynix—and their key clients. The recent rally in memory prices is expected to contribute positively to the second-quarter earnings of these leading memory chip producers.

All Comments (0)