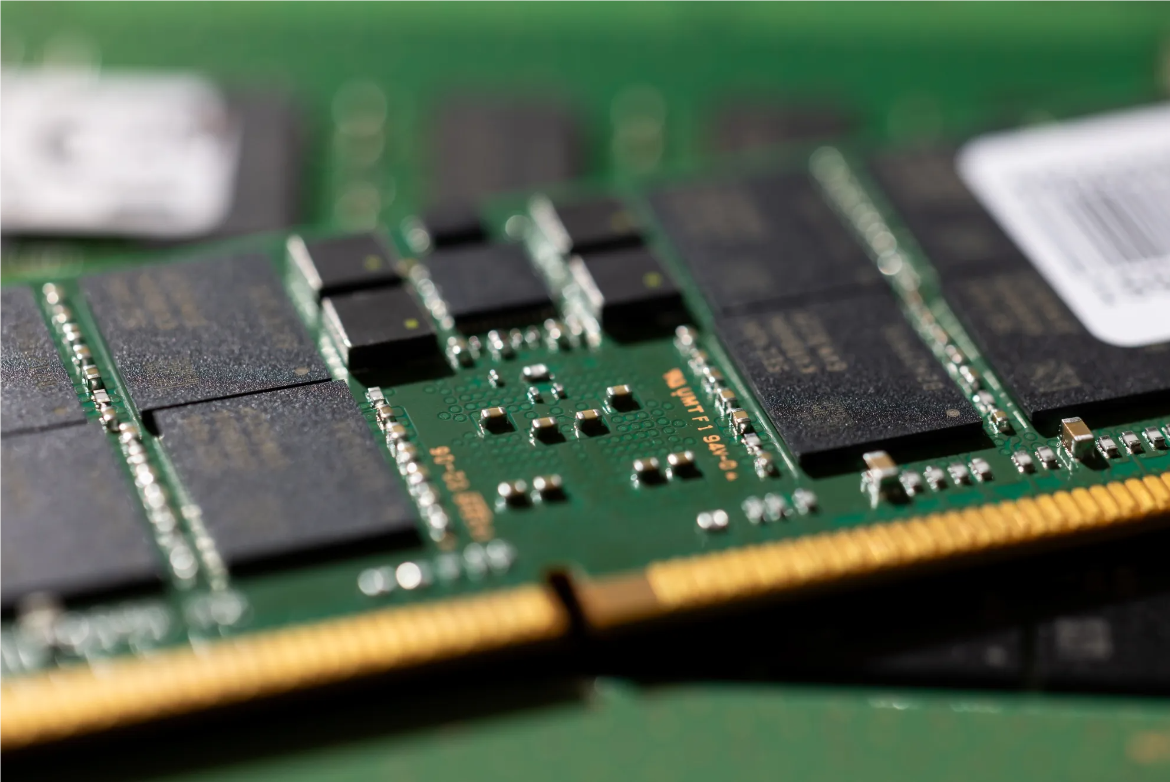

February 12, 2025 /SemiMedia/ — The DRAM market is expected to see a continuation of its price decline into the second half of the year, driven by weak demand for IT products and increased supply from Chinese manufacturers. In particular, server DRAM prices are expected to experience a significant drop, after holding relatively stable last year.

According to a report by market research firm Omdia on February 7, prices for DRAM used in PCs, servers, and mobile devices are expected to continue falling through at least the third quarter of this year. Specifically, a price decline of approximately 10% is forecast for the first half, with a further 5% drop anticipated in the second half.

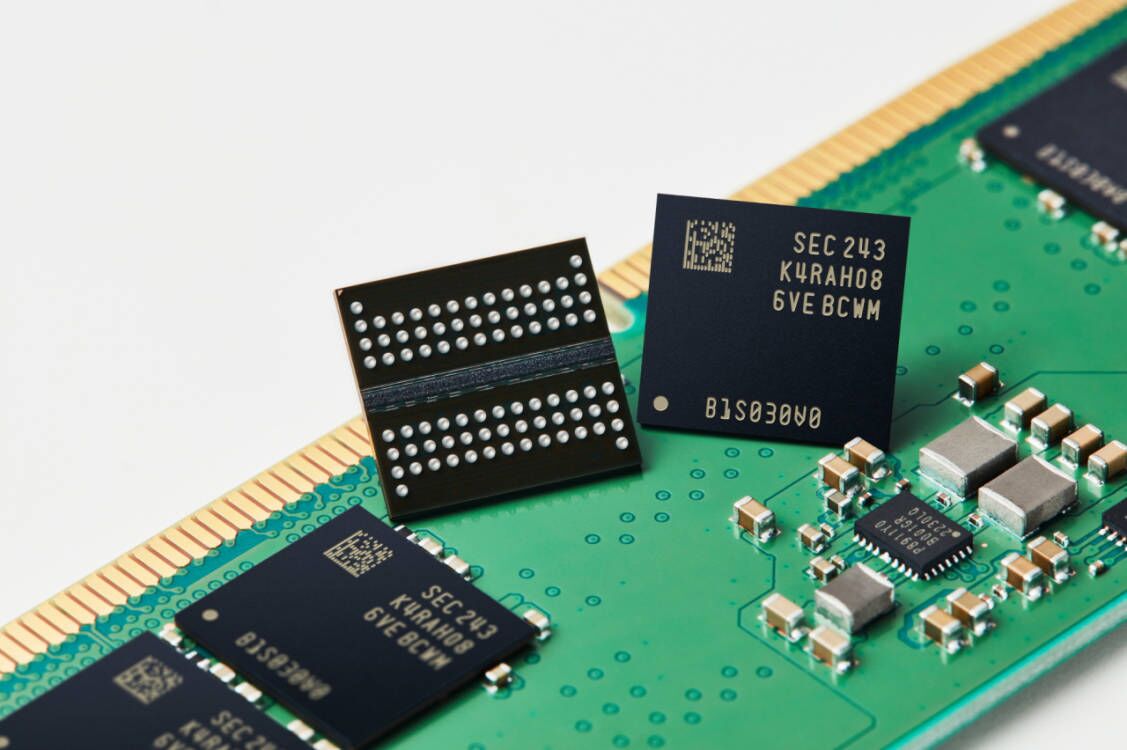

As a result of weak semiconductor demand and oversupply last year, prices for older semiconductor products have fallen, and both DDR4 and the latest DDR5 products are experiencing price reductions this year. Omdia predicts that the price of a 64GB server DDR5 module will drop from $270 in Q4 2024 to $248 in Q1 2025, and further decrease to $228 in Q2 2025. Some analysts expect prices could fall to just above $200 by Q4 2025.

With the entry of Chinese manufacturers into the DDR5 market, major memory companies such as Samsung Electronics and SK hynix have also reduced their first-quarter shipments, leading to expectations of overall market contraction.

In its earnings report at the end of last month, Samsung Electronics noted that inventory adjustments for mobile devices and PCs are expected to continue into the first quarter, while delays in GPU supply have caused some data center customers to push back their demands, resulting in a lag in memory demand.

Industry experts are closely watching whether the DRAM market can recover in the second half of the year. Prices are expected to continue to decline, with inventory adjustments and a potential rebound in shipments seen as key factors for any market recovery.

All Comments (0)