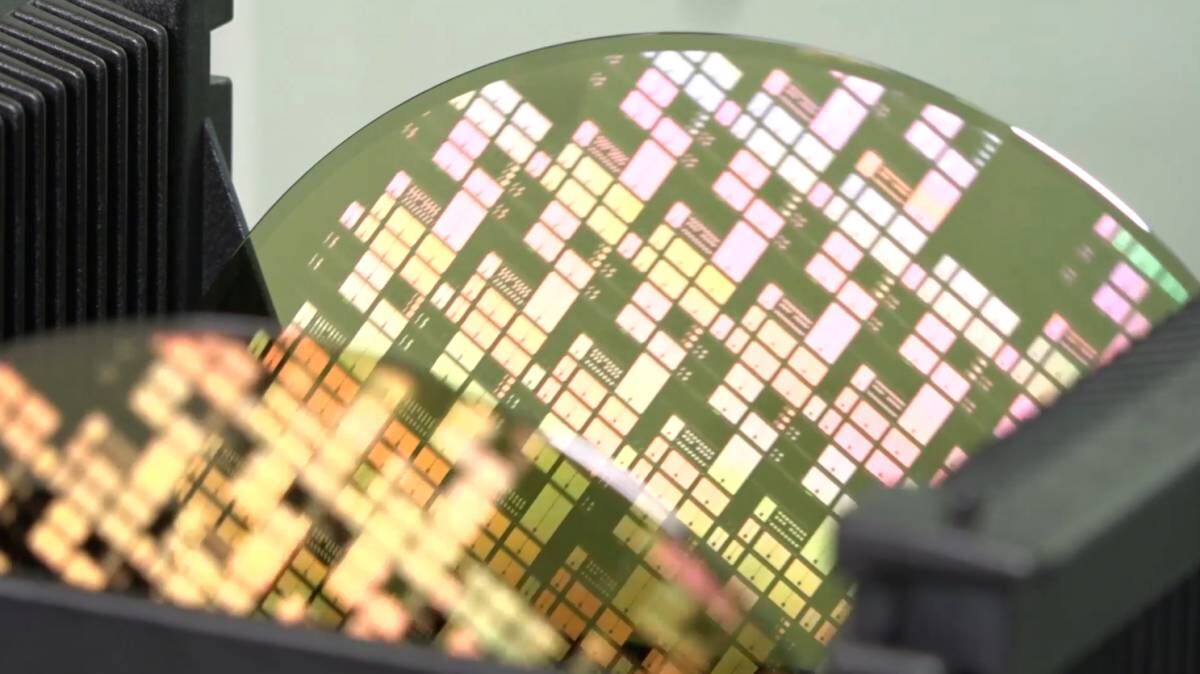

May 29, 2024 /SemiMedia/ -- According to Fuji Keizai's latest report on the power device wafer market, the power semiconductor market is expected to grow 23.4% year-on-year to 281.3 billion yen (about 1.795 billion U.S. dollars) in 2024. Although the silicon power semiconductor silicon wafer market has declined from the previous year due to inventory adjustments, due to the increase in production capacity of major manufacturers, SiC die sales are expected to increase by 56.9% year-on-year, exceeding the silicon wafer market.

The report points out that from 2025, the market is expected to expand as demand for power semiconductors continues to grow. In particular, SiC wafers are expected to become a long-term market driver due to increased demand brought about by the electrification of automobiles, and silicon wafers are also expected to be free from the impact of production adjustments. In addition, the increase in GaN wafer diameter and the start of mass production of gallium oxide wafers are expected to expand the market size to 1076.3 billion yen (about 6.866 billion US dollars) in 2035, 4.7 times that of 2023.

The report also pointed out that in recent years, as the demand for power semiconductors has increased, the diameter of wafers has continued to increase in order to ensure supply. In addition to the shift to 300mm silicon wafers, the SiC bare wafer market is expected to see a surge in demand for 8-inch (200mm) wafers from 2025.

Currently, most silicon power semiconductors are supplied by 8-inch wafers, and it is expected that 8-inch wafers will still account for more than 60% in the future. 300mm wafers are increasingly used for IGBTs and MOSFETs, and their adoption is expected to increase further as demand in the automotive and electrical equipment fields increases.

In addition, SiC bare wafers are currently dominated by 6-inch wafers, and this situation is expected to continue for some time, but the 8-inch wafer market is expected to take shape from 2025, and some sample shipments have already begun. It is expected that by 2035, it will account for 13.3% of all SiC bare wafers (in terms of wafer quantity). However, traditional 4-inch wafers are expected to be deployed only in some regions such as China and Japan. The market size is expected to shrink in the future.

All Comments (0)