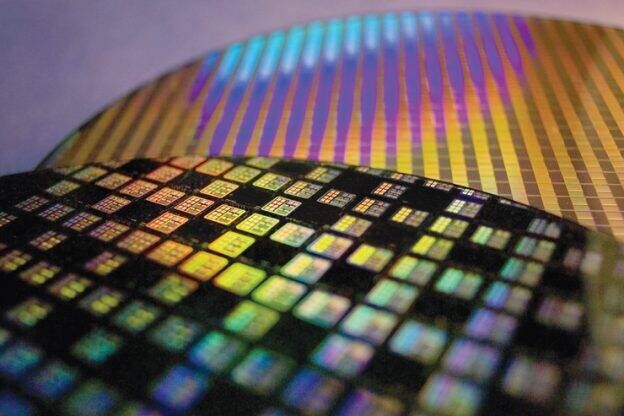

April 5, 2024 /SemiMedia/ -- Intel disclosed on April 3 that its foundry business had an operating loss of $7 billion in 2023, which was larger than the $5.2 billion operating loss in 2022. In addition, its revenue in 2023 was $18.9 billion, down 31% from $63.05 billion in 2022.

CEO Pat Gelsinger said that 2024 will be the company's worst year for operating losses in its chip manufacturing business, and it is expected to achieve operating breakeven by around 2027.

Gelsinger said the manufacturing business has been weighed down by bad decisions, including opposing the use of ASML for EUV equipment a year ago. While these machines can cost more than $150 million, they are more cost-effective than earlier chipmaking tools.

Partly as a result of these missteps, Gelsinger said, Intel has outsourced about 30% of its wafer total to outside contract manufacturers such as TSMC. It aims to reduce that number to around 20%.

Intel has now switched to EUV tools, which will serve more and more production needs as older machines are phased out.

“In the pre-EUV era, we incurred significant costs and were uncompetitive,” Gelsinger said. “In the post-EUV world, we find that we are now very competitive on price, performance and regaining leadership.”

All Comments (0)