December 14, 2023 /SemiMedia/ -- According to SEMI's latest report, total global sales of semiconductor manufacturing equipment by original equipment manufacturers are expected to reach US$100 billion in 2023, a 6.1% decrease from last year's record US$107.5 billion. Growth is expected to resume in 2024 and reach a new high of $124 billion in 2025.

"We anticipate a temporary contraction in 2023 due to the cyclical nature of the semiconductor market," said Ajit Manocha, SEMI President and CEO. "2024 will be a transition year. We then expect a strong rebound in 2025, driven by capacity expansion, new fab projects, and high demand for advanced technologies and solutions across the front-end and back-end segments."

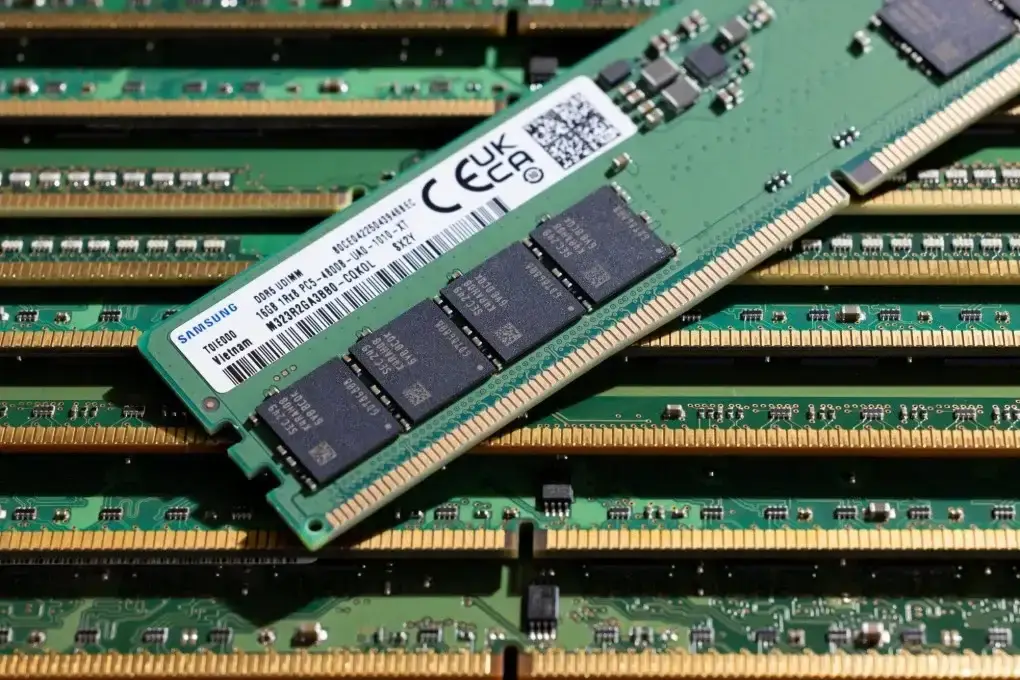

By equipment type, sales of fab equipment, including wafer processing, fab facilities and mask/reticle equipment, are expected to decline 3.7% year-on-year in 2023 to US$90.6 billion, compared with US$94 billion in 2022. Sales in the wafer fab equipment sector are expected to grow by 3% in 2024 due to increased memory chip production capacity and paused expansion of mature production capacity. This type of equipment is expected to grow by a further 18% in 2025 as new fab projects, capacity expansion and technology migration increase total industry investment.

The testing equipment, assembly and packaging equipment fields are expected to grow by 13.9% and 24.3% respectively in 2024. It is expected that the back-end market will continue to grow in 2025, with sales of test equipment increasing by 17% and packaging equipment sales increasing by 20%.

By application, SEMI expects equipment sales for Foundry and Logic applications to account for more than half of total fab equipment revenue, growing 6% to $56.3 billion in 2023, contracting 2% in 2024, and growing 15% to $63.3 billion in 2025.

All Comments (0)