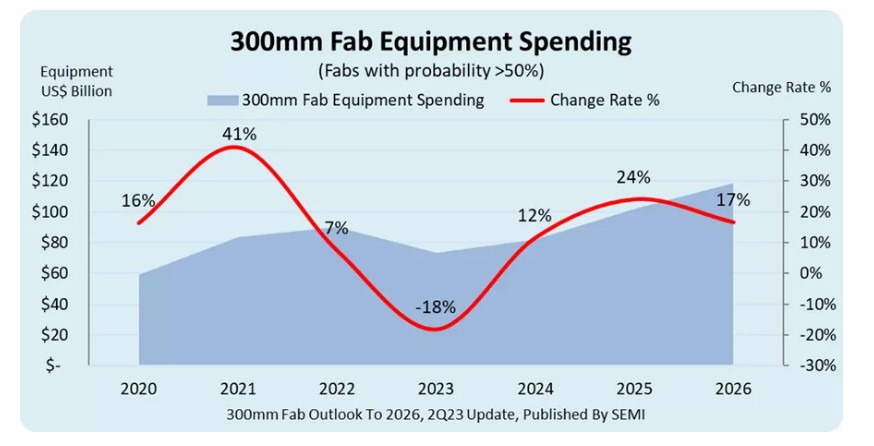

Jun 15, 2023 /SemiMedia/ -- Following a decline in 2023, global spending on 300mm fab equipment for front-end facilities is expected to begin growing sequentially next year, hitting an all-time high of $119 billion in 2026, according to SEMI’s latest report. Strong demand for high-performance computing, automotive applications and improved demand for memory will fuel double-digit spending in equipment investments over the three-year period.

SEMI stated that after the projected 18% drop to $74 billion this year, global 300mm fab equipment spending is forecast to rise 12% to $82 billion in 2024, 24% to $101.9 billion in 2025 and 17% to $118.8 billion in 2026.

“The projected equipment spending growth wave underscores the strong secular demand for semiconductors,” said Ajit Manocha, SEMI President and CEO. “The foundry and memory sectors will figure prominently in this expansion, pointing to demand for chips across a wide breadth of end markets and applications.”

Korea is expected to lead global 300mm fab equipment spending in 2026 with $30.2 billion in investments, nearly doubling from $15.7 billion in 2023. Taiwan region is forecast to invest $23.8 billion in 2026, up from $22.4 billion this year, and China is projected to log $16.1 billion in spending in 2026, an increase from $14.9 billion in 2023. Americas equipment spending is expected to nearly double from $9.6 billion this year to $18.8 billion in 2026.

Foundry is projected to lead other segments in equipment spending at $62.1 billion in 2026, an increase from $44.6 billion in 2023, followed by memory at $42.9 billion, a 170% increase from 2023. Analog spending is forecast to increase from $5 billion this year to $6.2 billion in 2026. The microprocessor/microcontroller, discrete (mainly power devices), and optoelectronics segments are expected to see spending declines in 2026, while investments in logic is forecast to rise.

All Comments (0)