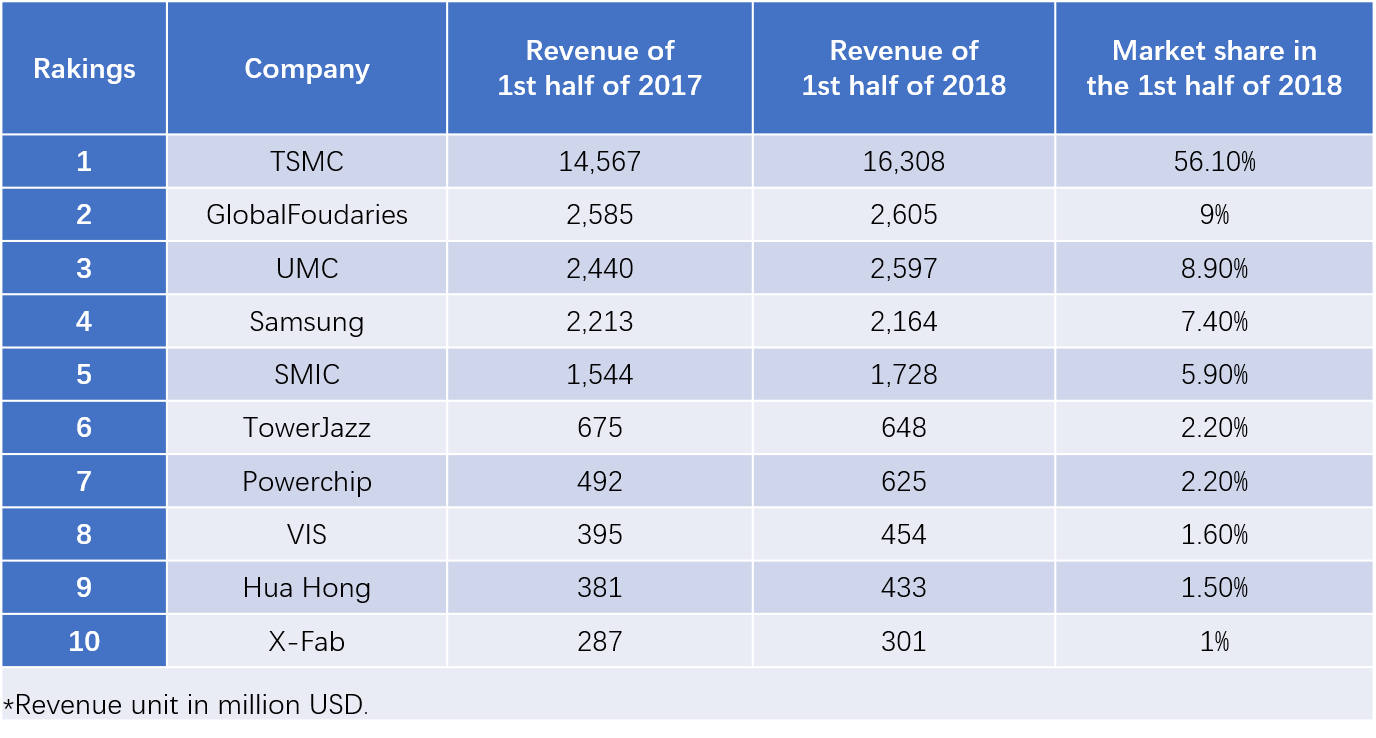

According to the latest report from TRI, due to the lower demand for high-end smart phones in the first half of 2018, and the increasingly obscure demarcation between high-end and mid-range smart phones introduced by manufacturers, the new features introduced by smart phone manufacturers have not stimulated customer replacement as expected. Demand, indirect suppression of smart phone manufacturers' demand for high-performance processors is not as usual, and foundry industry is facing slowing down of advanced technology development, making the annual growth rate of global foundry output value in the first half of this year will be lower than the same period of last year. Estimated output value reached US$29.06 billion, with an annual growth rate of 7.7%. The top three market share players are TSMC, GlobalFoundries and UMC.

TRI pointed out that in the first half of 2018, the ranking of foundry industry players did not change much compared with the same period of last year. TSMC, which accounts for nearly 70% of the world’s advanced process output, was also affected by the decline in mobile phone demand in the first half of the year. Although the revenue growth from advanced technology was not as good as expected, its market share still reached 56.1%; GlobalFoundries ranked second in the first half of the year. There has been no major change in the major customer structure, which is smaller than the change in revenue during the same period last year.

UMC ranked third in revenue in the first half of the year. Due to pressure from TSMC’s high share of advanced technology, UMC’s revenue growth was limited. Currently, the development of 28nm and 14nm new customers to develop advanced process capacity is the development Focus; The fourth-ranking Samsung is actively launching Multi-Project Wafer (MPW) to strengthen the possibility of cooperation with new customers. The fifth-ranked SMIC, its 28nm yield bottleneck remains to be broken. Due to the good condition of local customers in mainland China, mature technology performance is still the main force to support their revenue growth.

In addition, TRI pointed out that wafer manufacturing companies have made new progress in the investment in third-generation semiconductors. VIS will provide 8-inch GaN-on-Silicon foundry services and become the first company in the world to provide 8-inch GaN-on-Silicon services.

All Comments (0)