IC Insights recently released its updated McClean report in May 2018.

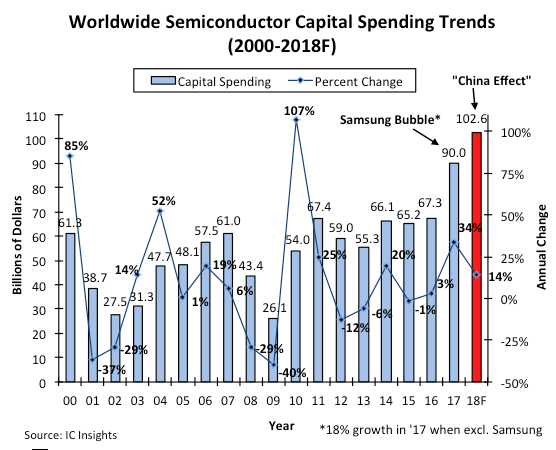

Overall, the actual results of capital expenditures in 2018 are more positive than the predictions made by IC Insights, which can be seen in the updated Macleans Report 2018 (MR18) in March. IC Insights forecasts that capital expenditures in the semiconductor industry will increase by 8% this year. However, as shown in the chart, IC Insights has raised its forecast for capital expenditure in 2018 by 6 percentage points to a 14% increase. If such growth does occur, it will be the first time that capital expenditures in the semiconductor industry have exceeded 100 billion U.S. dollars. Global 2018 capital expenditure forecast data is 53% higher than 2016 data.

Although Samsung stated that it has not had a full-year capital expenditure forecast this year, it does indicate that the expenditure of semiconductor capital expenditures in 2018 is “less” compared to 2017, with a specific cost of US$24.2 billion. However, with its capital spending for the first quarter of 2018, Samsung spent $6.72 billion on capital expenditures for its semiconductor sector, slightly higher than the average of the first three quarters. This figure is almost four times the amount spent in the first quarter of 2016! In the past four quarters, Samsung spent $26.6 billion in capital expenditures for its semiconductor group.

IC Insights estimates that Samsung Semiconductor Group’s capital expenditure this year will reach US$20 billion, a decrease of US$4.2 billion from 2017. However, given the strong start of spending this year, there currently appears to be greater downside potential.

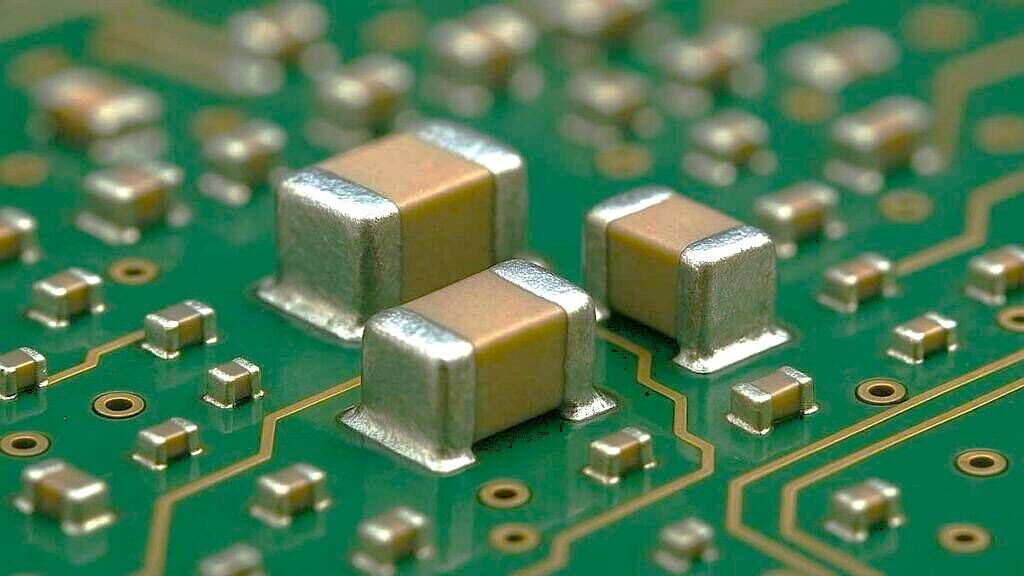

Since the DRAM and NAND flash memory markets are still very strong, SK hynix’s capital expenditure is expected to increase to 11.5 billion U.S. dollars this year, a 42% increase from the 8.1 billion U.S. dollars in 2017. The increase in SK hynix's spending this year will focus primarily on the launch of two large memory factories M15, a 3D NAND flash memory manufacturing facility in Cheongju, South Korea, and the expansion of its huge DRAM plant in Wuxi, China. The Cheongju factory will be open before the end of this year, and the Wuxi fab will also be planned to open before the end of this year, a few months earlier than originally scheduled for the start of 2019.

All Comments (0)