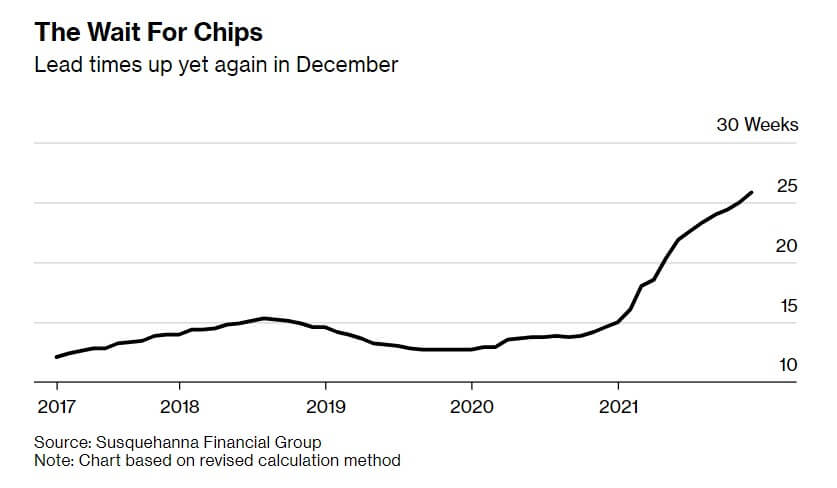

According to Bloomberg quoted Susquehanna Financial Group's report, the chip lead time was further extended to 25.8 weeks in December 2021, an increase of six days from November, setting a record for the longest lead time since data tracking started in 2017.

The report pointed out that Susquehanna recently changed the method of calculating lead time by adding more data sources, and revised previous estimates based on the new system.

“The rate of lead time expansion has been choppy, but picked up again in December,” Susquehanna analyst Chris Rolland said Tuesday in a research note. “Lead times for nearly every product category witnessed all-time highs, with power management and MCUs (microcontrollers) leading the charge.”

Bloomberg stated that in the past, lengthening lead times have been followed by painful periods of oversupply. The concern is that customers may try to purchase more than they need now in an effort to ensure they get chips and will later cancel the requests, which the industry calls double ordering.

The report shows that although the average lead time is lengthening again, some large suppliers are delivering products to customers in a more timely manner.

All Comments (0)