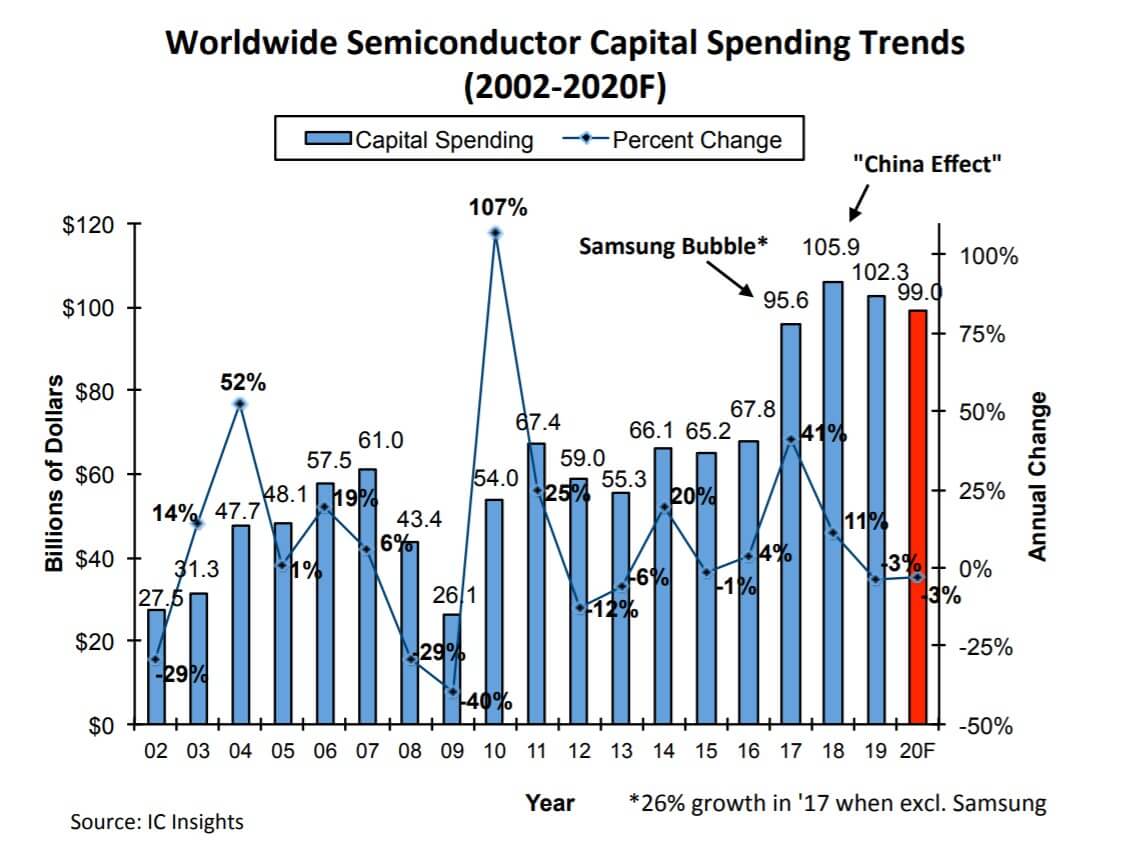

According to IC Insights' forecast, global semiconductor capital expenditure will drop by 3% this year.

IC Insights pointed out that the main reason for the decline in capital expenditure this year is the decrease in the expenditures of three major memory suppliers, Samsung, SK Hynix and Micron. The capital expenditures of these three companies are expected to be USD 33.6 billion this year, a 15% decrease from USD 38.7 billion in 2019. In comparison, other semiconductor manufacturers' total spending in 2019 was US $ 62.6 billion, and it is expected to spend US $ 65.4 billion by 2020, an increase of 4%.

In addition, in 2019, driven by the surge in TSMC's spending, capital spending in the foundry sector increased the most, jumping by 17%. It is expected that by 2020, the foundry industry will once again show strong spending growth, up 8%.

Except for 2018, since 2015, wafer foundries have been in a leading position in terms of product expenditure each year. IC Insights predicts that wafer foundries will again account for the largest percentage of semiconductor industry capital expenditures in 2020, reaching 29%.

It is worth mentioning that compared with 2018, TSMC's expenditure in 2019 increased by about 4.5 billion US dollars. However, in 2020, TSMC's spending growth is expected to be 563 million US dollars, while SMIC plans to increase its spending by about 1.1 billion US dollars this year.