TDK announced yesterday that it will raise its consolidated revenue target from 1.34 trillion yen to 1.42 trillion yen this year, mainly due to the upgrade of smartphone and vehicle electronization improves the sales of high end MLCC. From the last quarter's financial report released by TDK, the demand for automotive MLCC was extremely strong, which led to a 13.4% increase in TDK revenue and a 33.3% increase in consolidated revenue. TDK President Shigenao Ishiguro said that TDK is expanding its MLCC capacity by 20% annually.

On October 30th, SemiMedia reported on Murata's views on the MLCC market. Its view is basically consistent with TDK. Due to the strong demand for automotive MLCC, the overall sales performance is booming. The sales in the previous quarter increased by 30.6% compared with the same period of last year. Tsuneo Murata, president of Murata Manufacturing Co., said in an interview that MLCC will continue to show tight supply in the next two years.

On the other hand, Samsung, the world's second-largest MLCC vendor, broke the record in the third quarter, benefiting from MLCC demand, revenue increased by 69%. Looking forward to the fourth quarter, Samsung and Yageo believe that the season is off-season, revenue will decline, but MLCC sales will continue to grow. Analyst Park Gang-ho pointed out that smartphone and car performance improvements will keep MLCC profitable next year. SemiMedia reported on Samsung's expansion plan on September 18th, which will spend $443 million won to increase the MLCC capacity of the Tianjin plant in China.

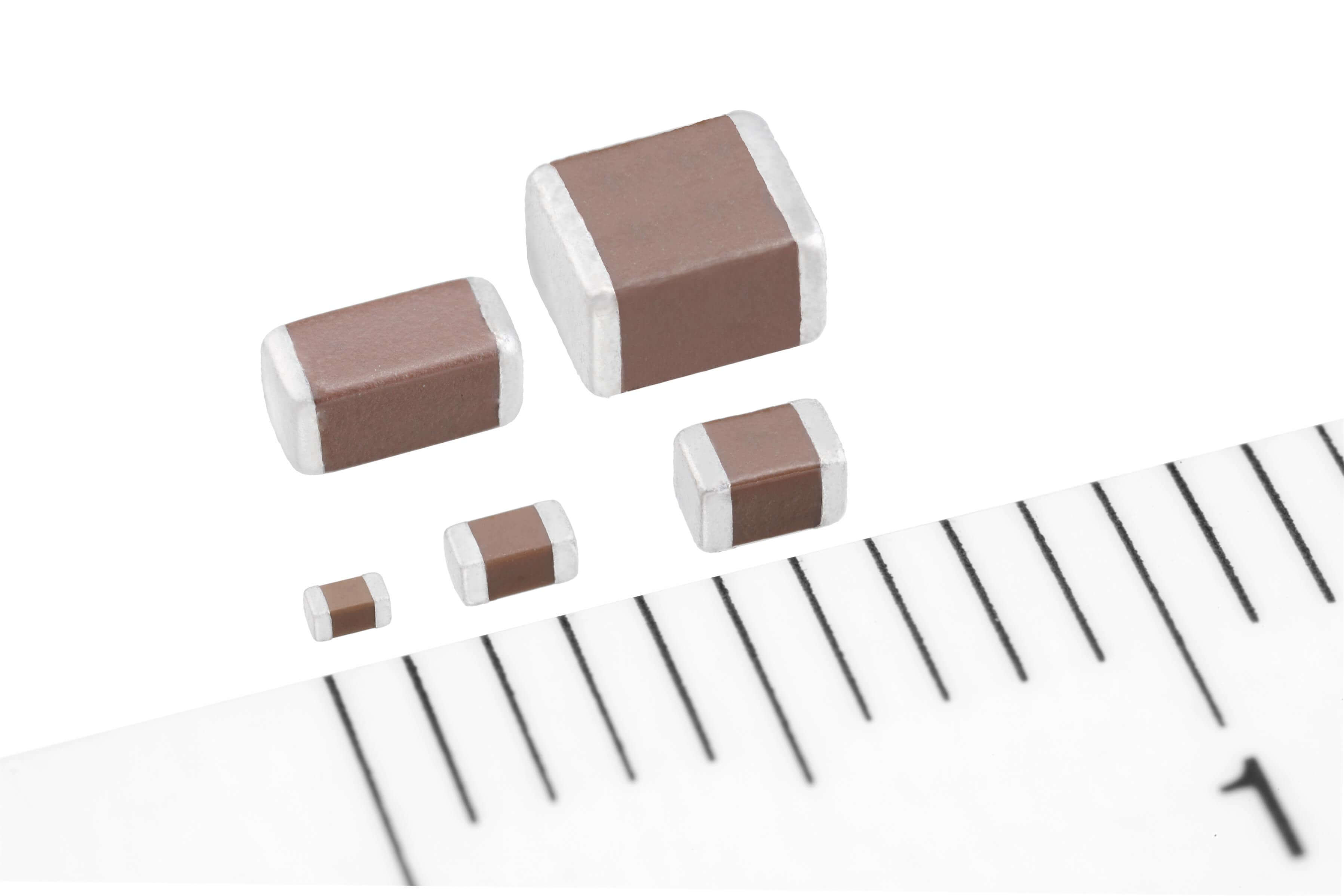

Combined with yesterday's report on the MLCC price decline, there are two completely opposite trends in the MLCC market. First, the low-capacitance MLCC price may continue to fall, the producers are mainly from Taiwan; The second is the automotive, industrial and other high-capacitance MLCCs continue to be in short supply, the producers are mainly from Japan and South Korea. This also proves that the Japanese and Korean manufacturer’s strategy of adjusting the product structure and changing the market direction two years ago is correct.

All Comments (0)