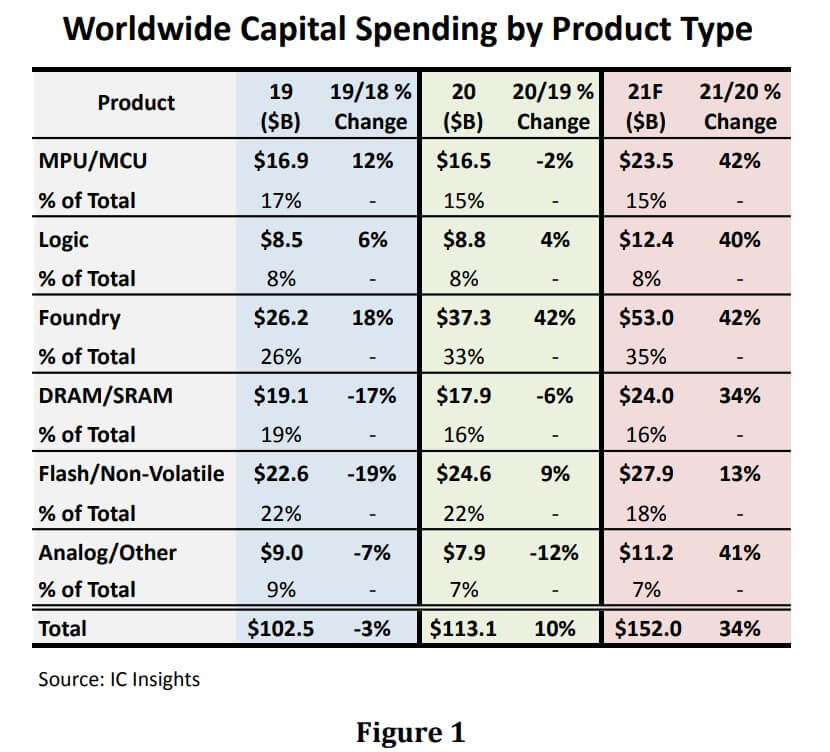

According to IC Insights’ latest report, worldwide semiconductor capex is on track to surge 34% in 2021, its strongest percentage gain since a 41% increase in 2017. The $152.0 billion in outlays this year would represent a new record high annual amount of spending, surpassing the previous high mark of $113.1 billion set just last year. Figure 1 shows a split of semiconductor capital spending by leading product segment for 2019 through 2021.

As shown, the foundry segment is forecast to represent 35% of all semiconductor capital spending in 2021, easily the largest portion of capex spending among the major product/segment categories. Foundry has accounted for the largest share of semiconductor capex each year since 2014 with two exceptions—2017 and 2018 when capex spending for DRAM and flash memory surged. Spending by foundries has become very important (and necessary) as industry demand continues to rise for ICs fabricated using advanced process technology nodes.

TSMC, the world’s largest foundry, is forecast to account for 57% of the $53.0 billion in foundry spending this year. Samsung is also making significant investments in its foundry operations. Samsung has been able to match the technology roadmap of TSMC and continues its effort to lure more leading-edge fabless logic suppliers away from its pure-play foundry rival.

On the other hand, SMIC was being counted on by the Chinese government to supply a much greater portion of semiconductors to the China market. But SMIC’s inclusion on the U.S. blacklist has severely curtailed its ability to carry out those plans. SMIC’s capex spending is forecast to drop 25% this year to $4.3 billion, accounting for only 8% of total foundry outlays in 2021.

IC Insights stated that by 2021, all of the product segments are forecast to register strong double-digit increases in capital outlays with the foundry and MPU/MCU segments expected to log the largest year-over-year spending increases at 42% followed by analog/other (41%) and logic (40%).

All Comments (0)