NVIDIA and SoftBank Group Corp. (SBG) announced a definitive agreement under which NVIDIA will acquire Arm Limited from SBG and the SoftBank Vision Fund (together, “SoftBank”) in a transaction valued at $40 billion. The transaction is expected to be immediately accretive to NVIDIA’s non-GAAP gross margin and non-GAAP earnings per share.

The combination brings together NVIDIA’s leading AI computing platform with Arm’s vast ecosystem to create the premier computing company for the age of artificial intelligence, accelerating innovation while expanding into large, high-growth markets. SoftBank will remain committed to Arm’s long-term success through its ownership stake in NVIDIA, expected to be under 10 percent.

As part of NVIDIA, Arm will continue to operate its open-licensing model while maintaining the global customer neutrality that has been foundational to its success, with 180 billion chips shipped to-date by its licensees. Arm partners will also benefit from both companies’ offerings, including NVIDIA’s numerous innovations.

SoftBank and Arm are fully committed to satisfying the undertakings made by SoftBank when it acquired Arm in 2016, which are scheduled to complete in September 2021. Following the closing of the transaction, NVIDIA intends to retain the name and strong brand identity of Arm and expand its base in Cambridge. Arm’s intellectual property will remain registered in the U.K.

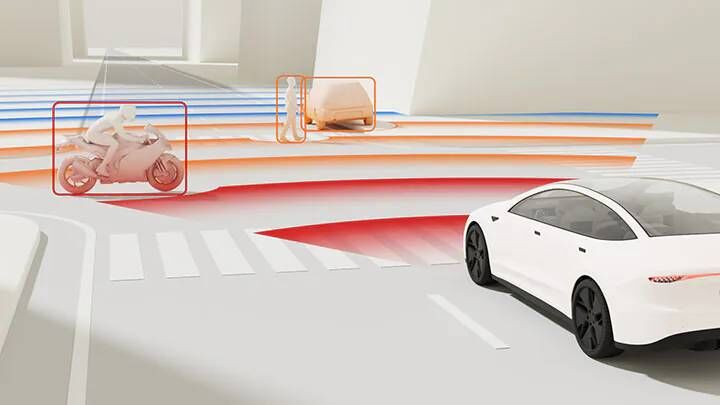

NVIDIA will build on Arm’s R&D presence in the U.K., establishing a new global center of excellence in AI research at Arm’s Cambridge campus. NVIDIA will invest in a state-of-the-art, Arm-powered AI supercomputer, training facilities for developers and a startup incubator, which will attract world-class research talent and create a platform for innovation and industry partnerships in fields such as healthcare, robotics and self-driving cars.

Under the terms of the transaction, which has been approved by the boards of directors of NVIDIA, SBG and Arm, NVIDIA will pay to SoftBank a total of $21.5 billion in NVIDIA common stock and $12 billion in cash, which includes $2 billion payable at signing. The number of NVIDIA shares to be issued at closing is 44.3 million, determined using the average closing price of NVIDIA common stock for the last 30 trading days. Additionally, SoftBank may receive up to $5 billion in cash or common stock under an earn-out construct, subject to satisfaction of specific financial performance targets by Arm.

NVIDIA will also issue $1.5 billion in equity to Arm employees.

NVIDIA intends to finance the cash portion of the transaction with balance sheet cash. The transaction does not include Arm’s IoT Services Group.

The proposed transaction is subject to customary closing conditions, including the receipt of regulatory approvals for the U.K., China, the European Union and the United States. Completion of the transaction is expected to take place in approximately 18 months.

All Comments (0)