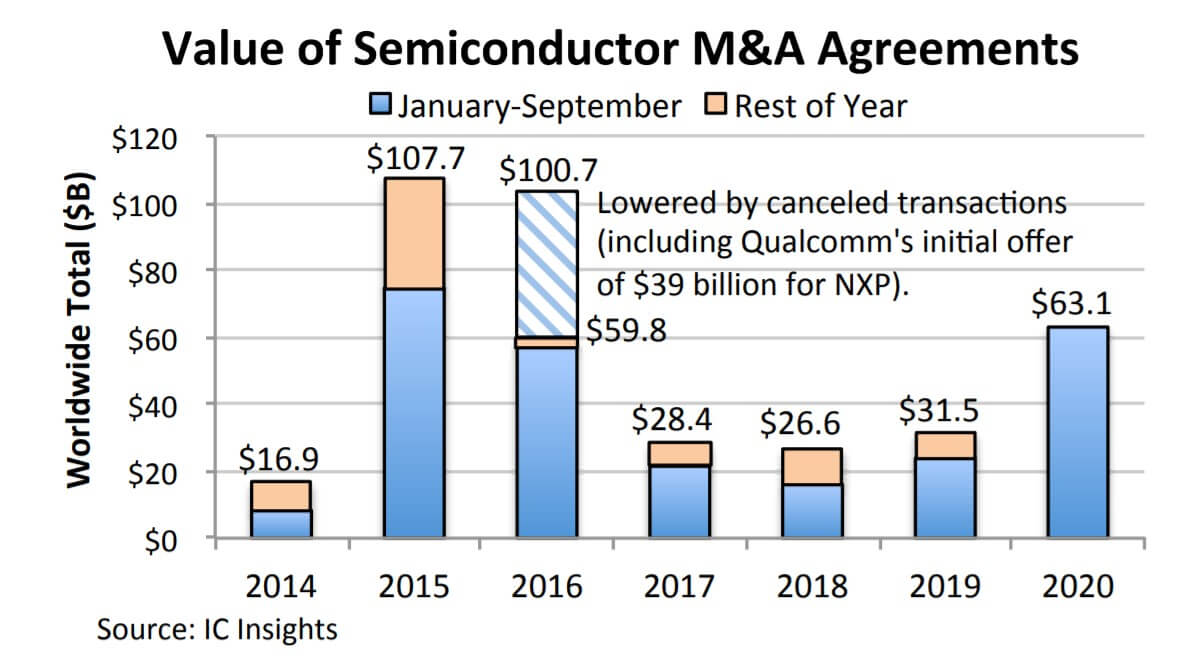

Recently, IC Insights released a report saying that ADI’s acquisition of Maxim and Nvidia’s acquisition of Arm will make the total value of this year’s M&A transactions exceed $63 billion.

IC Insights pointed out that the two huge merger agreements reached in July and September make 2020 at least the second highest year in the history of semiconductor mergers and acquisitions.

In the first nine months of 2020, the total value of semiconductor M&A agreements reached $63.1 billion. This is mainly due to the acquisition of chip design company Arm from SoftBank by Nvidia in September for US$40 billion and ADI's acquisition of analog/mixed-signal IC manufacturer Maxim for US$21 billion in July. These two transactions accounted for approximately 97% of the value of M&A in 2020.

Prior to the emergence of Nvidia-ARM and ADI-Maxim mergers and acquisitions, semiconductor M&A activity almost stagnated in 2020. The value of semiconductor M&A transactions in the first quarter was US$1.8 billion, and due to the global outbreak of Covid-19, M&A transactions in the second quarter were only US$165 million.

However, since Arm’s intellectual property rights dominate the development of global smartphones and other mobile processors, the Nvidia acquisition of ARM will inevitably face strict scrutiny in China, Europe and other markets.

All Comments (0)