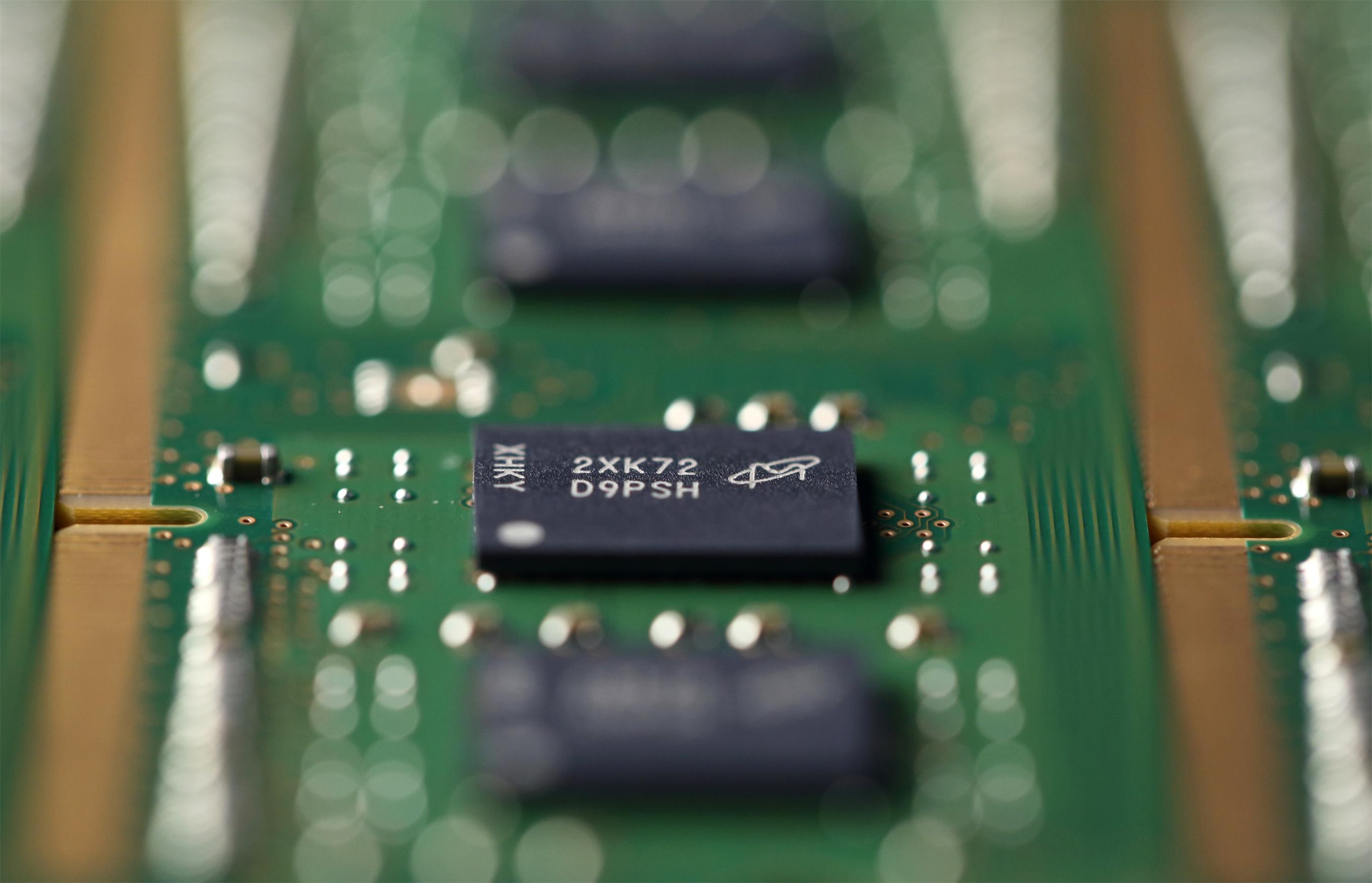

As reported, memory chip maker Micron has continued to increase investment, while South Korea's two major semiconductor companies, Samsung Electronics and SK Hynix, are closely monitoring market changes and adjusting investment rates.

Following the completion of the Singapore NAND flash memory factory this month, Micron confirmed that it will build the A3 fab in Taichung, Taiwan, and said it will expand globally, but will not increase production capacity.

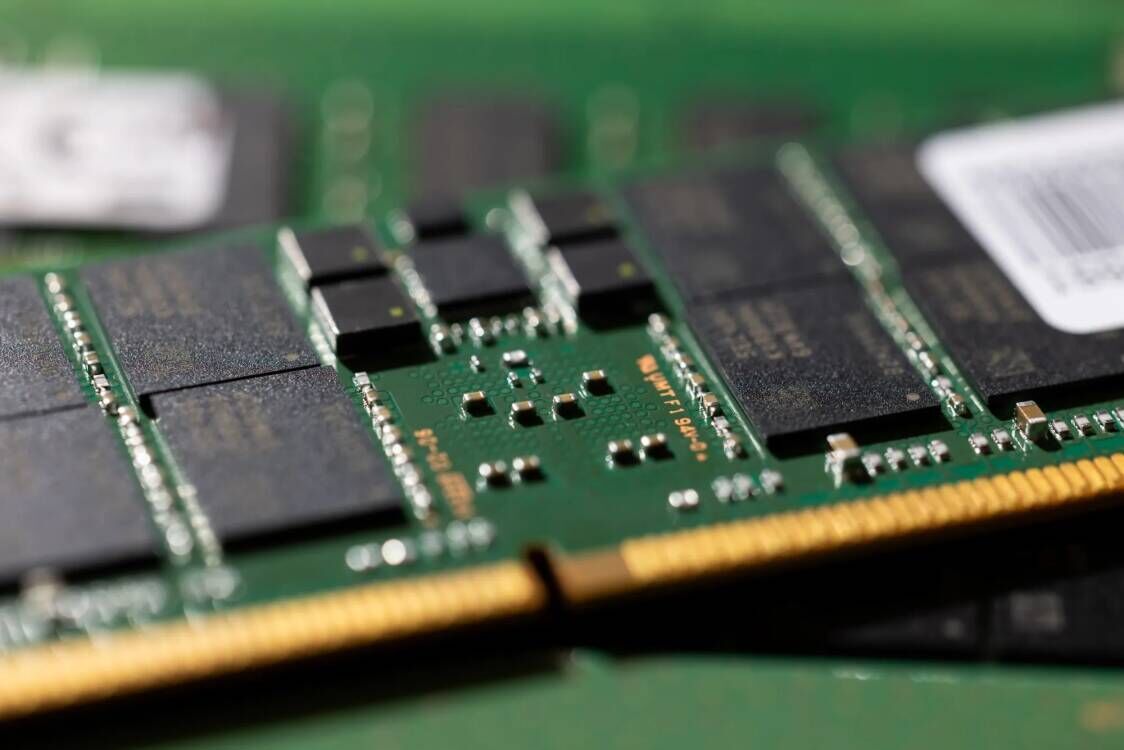

In contrast, Korean semiconductor companies have slowed their investment this year. In the first half of the year, Samsung Electronics' investment in semiconductor equipment was 19% less than that of the same period of last year, and it mainly invested in the construction of memory semiconductor clean rooms and EUV equipment.

Samsung Electronics said at the beginning of the year that there was no plan to build new semiconductor factory in 2019. However, it is widely expected that Samsung will invest more in the second half than in the first half of the year.

On the other hand, SK Hynix plans to reduce the M10 capacity of the DRAM factory, and will gradually convert the DRAM production line into an image sensor production line, and delay the mass production plan of DRAM factories such as M15 and M16.

According to analysts in the Korean semiconductor industry, Micron's DRAM factories in Taiwan are not large compared to Samsung and Hynix's factories. On the other hand, Korean companies are now focusing more on technology development, so it remains to be seen whether these investment plans of Micron will affect market supply and demand next year.

All Comments (0)