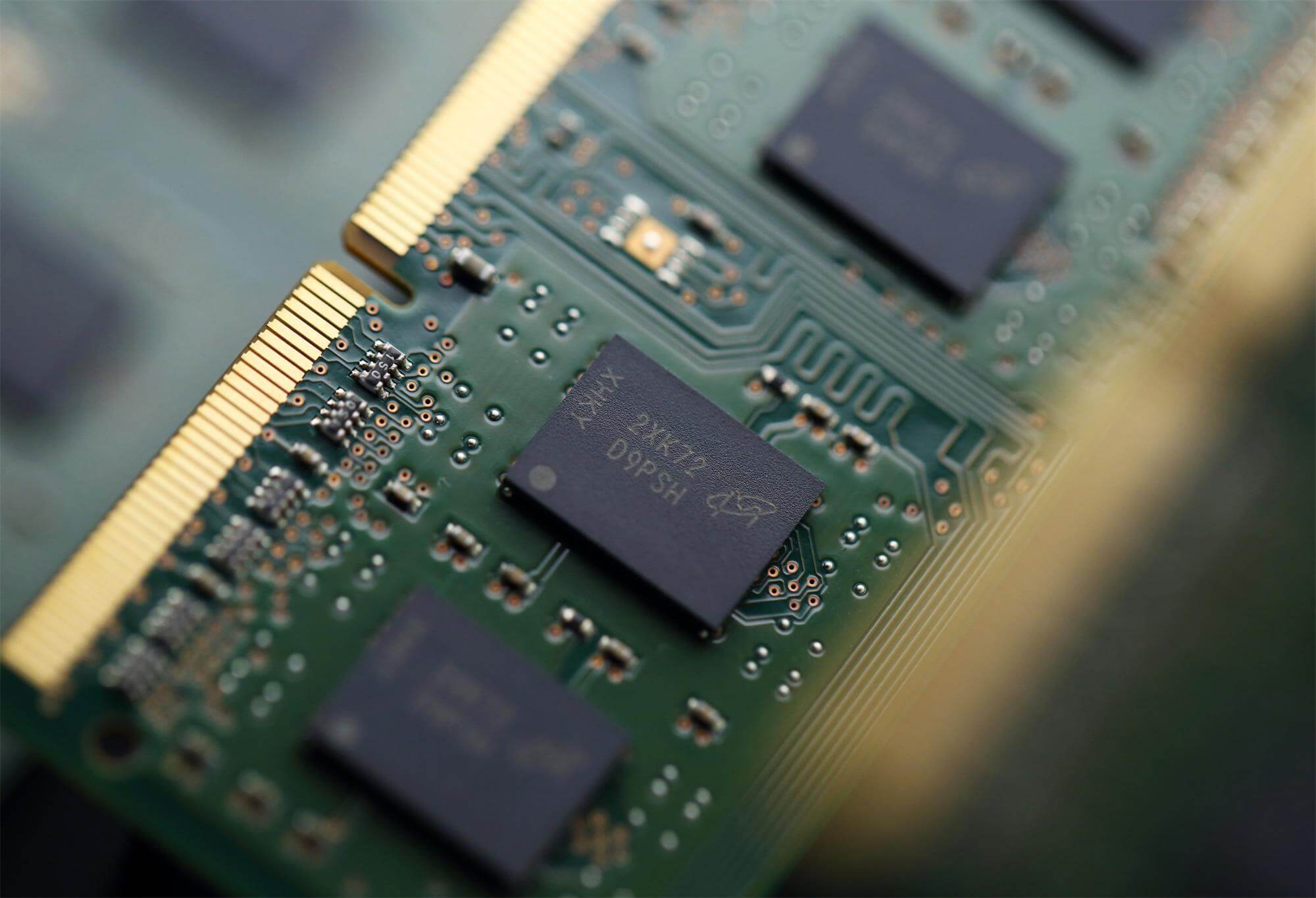

According to BusinessKorea, the spot price of memory chips is rapidly rebounding as the Japanese government restricts the export of semiconductor materials to South Korea. In this case, the global semiconductor market is expected to perform better than previously expected.

According to market research firm DRAMeXchange, DRAM spot prices have risen since last week, while NAND flash prices have started to rise at the end of last month. The price of PC DRAM (DDR4 8Gb) rose by 11.8% from July 11 to 15, while DDR3 4Gb rose by 13.7%. In the same period, the price of NAND flash memory (64Gb MLC) increased by 3.6%.

Just a month ago, DRAMeXchange predicted that NAND flash and DRAM prices would bottom out in the third quarter of this year and the second quarter of 2020, respectively. Obviously, the current situation is more optimistic than the forecast at the time.

This unexpected change in the memory chip market is related to export restrictions that began last week. “Japan’s export restrictions on South Korea have led to a rapid recovery in demand for NAND flash memory,” analysts explained. “The price of 3D NAND is close to its bottom line, and due to Toshiba’s power outages and export restrictions, inventory is rapidly declining. In this case, Customers want to buy more memory products."

The industry is closely watching the purchase of hydrogen fluoride, which is one of the chemicals restricted by the Japanese government. If trade disputes between South Korea and Japan continue, insufficient supply will seriously affect the production of memory chips.

All Comments (0)