Yageo's Chilisin announced today that it will acquire Magic Technology 100% shares. At present, the board of directors of both parties has passed the merger. The date for the conversion of shares is tentatively set to November 30, 2018.

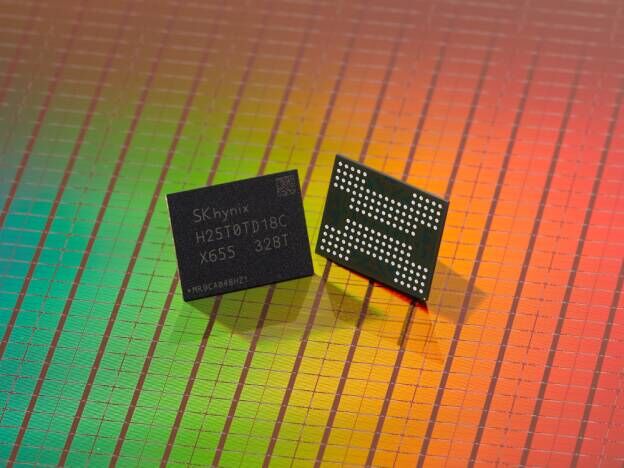

Magic Technology is a company specializing in R&D, production and sales of EMI components and wound inductors. It is headquartered in Taiwan and has several production sites in mainland China. Magic Technology has many international customers, including AMD, JabiI, Quanta, ASUS, LITE-ON, Samsung, Celestica, MiTAC, Shuttle, ECS, MSI, USI, Flextronics, Nvidia, Venture, Foxconn, Primax, Wistron, Gigabyte…etc.

Chilisin, a subsidiary of Yageo, is one of the few manufacturers in the world capable of providing a full range of inductive components. The product line includes EMI, Power, and RF. In addition, in the past few years, Chilisin acquired Mag.Layers, Ferroxcube and MXIC, which has enriched its inductor product line while adding a product line of resistor, array-resistor, and magnetic components. Today, together with Magic Technology, it will expand Chilisin's operating scale, enrich its product lines and customer base, and further enhance its global competitiveness, furthermore, with Magic Technology, Chilisin has become Taiwan only has a full range of inductor production processes and controls the production of upper-middle-stream producers and core technologies.

For the acquisition of Magic Technology, Chilisin expressed its expectation to expand the global scale of integrated power inductors by integrating the advantages of its various companies. After integration, product classification and customer classification can be implemented to implement all-round market strategy targets, and reduce the proportion of personnel, management, sales, and research and development costs, strengthen operating leverage, and improve profitability.

All Comments (0)