According to the latest report from Yole Dévelopement, the DRAM and NAND flash memory markets are expected to grow by 25% and 24% to $118 billion and $83 billion, respectively, in 2022, hitting record highs. In 2021-2027, the standalone memory market is expected to grow to over $260 billion at a CAGR of 8%.

“Amid trade-war tensions and the COVID-19 pandemic, the stand-alone memory market has been expanding throughout the last two years. Revenue was up 15% and 32% in 2020 and 2021, respectively. Such remarkable growth was made possible by a combination of constrained production and strong demand growth across most market segments,” said Simone Bertolazzi, Ph.D., Senior Market & Technology Analyst, Memory at Yole.

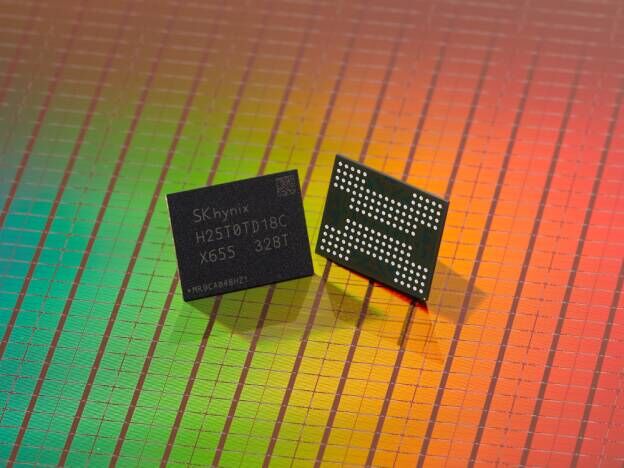

In the DRAM business, Yole pointed to the current consensus that in-plane scaling – even through lithography EUV processes – will not be sufficient to provide the required bit-density improvement for the entire next decade. Hence, monolithic 3D DRAM – the DRAM equivalent of 3D NAND – is being considered by major equipment suppliers and by leading DRAM manufacturers as a potential solution for long-term scaling. Yole’s analysts believe that this novel 3D technology could make its entry into the market in the 2029-2030 time frame.

All Comments (0)