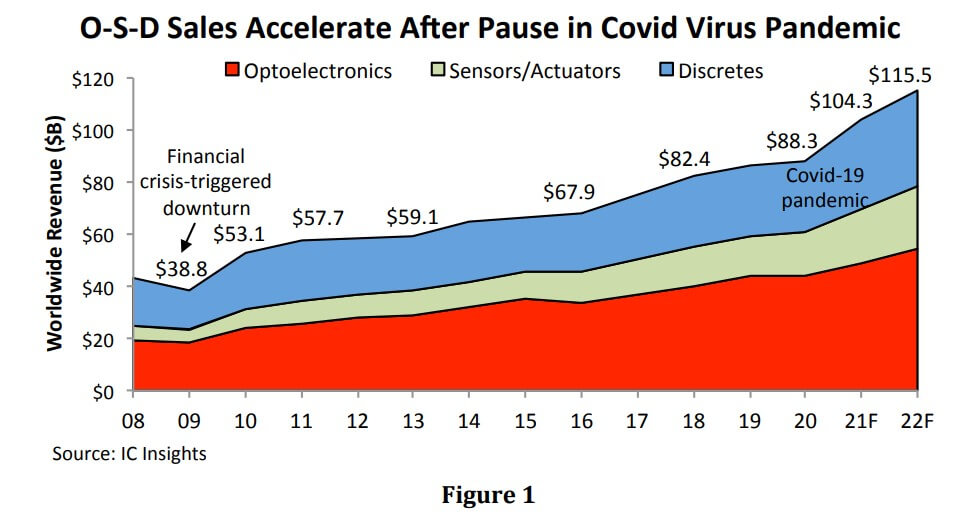

According to the latest report from IC Insights, global sales of optoelectronics, sensors/actuators, and discretes (O-S-D) are expected to grow 18% in 2021 to $104.3 billion from $88.3 billion in 2020, when this semiconductor market group increased by less than 3% during the Covid-19 virus outbreak year.

IC Insights stated that total O-S-D sales are forecast to rise 11% in 2022 to $115.5 billion (Figure 1). O-S-D products generate about 18% of the world’s total semiconductor sales with the rest (82%) coming from integrated circuits. Less than 13% of semiconductor revenues came from O-S-D products 25 years ago.

The report pointed out that the O-S-D market group has gradually accounted for a higher share of semiconductor revenues since the mid-1990s because of steady and often strong annual growth in sensors, actuators, CMOS image sensors, laser transmitters, and high-brightness light-emitting diodes (LEDs) during the past few decades. O-S-D sales have been driven by mobile systems—in particular smartphones, which are packed with digital cameras and sensors—as well as high-speed communications, the Internet of Things (IoT), and the recent explosion of embedded artificial intelligence (AI) in more systems.

Optoelectronics sales in 2021 are expected to grow 10% to a record-high $48.4 billion after being about flat in 2020 at $44.0 billion. The total optoelectronics market is expected to be held back by sales growth of just 7% in CMOS image sensors this year. CMOS image sensor leader Sony blames softer growth conditions in 2021 on trade frictions between the U.S. and China and a “deterioration of product mix.” CMOS image sensor sales have also been impacted by market fluctuations in some end-use applications, and shortages of ICs and other components used in digital-imaging systems.

Sales of non-optical sensors and total actuator devices are forecast to climb nearly 27% in 2021 to reach an all-time high of $20.9 billion compared to $16.5 billion in 2019, when revenues grew 11%. Worldwide discretes revenues are expected to surge about 26% to $35.0 billion in 2021—which will be the fourth largest annual percentage increase in the last 40 years for this commodity-filled semiconductor segment— after growing less than 3% in 2020 to $27.8 billion.

IC Insights pointed out that in the 2021 economic rebound from the 2020 coronavirus-driven recession, the broad comeback in semiconductor demand has overwhelmed chipmakers and the global supply chain, causing lead times for delivery of many O-S-D products to exceed four or five months versus six to eight weeks in normal market conditions. About a dozen commodity and widely used O-S-D product categories are expected to display very high sales growth this year primarily because of strong increases in average selling prices (ASPs) and high demand for units as many systems manufacturers—including carmakers—struggle to keep up with their own market recoveries. A total of 16 O-S-D product categories and segments are expected to achieve new record-high sales levels in 2021—tying the most in a year (2018) since 2000.