IC Insights released the latest report yesterday and published its outlook on China's semiconductor industry in the next 5 years.

IC Insights pointed out that, A very clear distinction should be made between the IC market in China and indigenous IC production in China. As IC Insights has oftentimes stated, although China has been the largest consuming country for ICs since 2005, it does not necessarily mean that large increases in IC production within China would immediately follow.

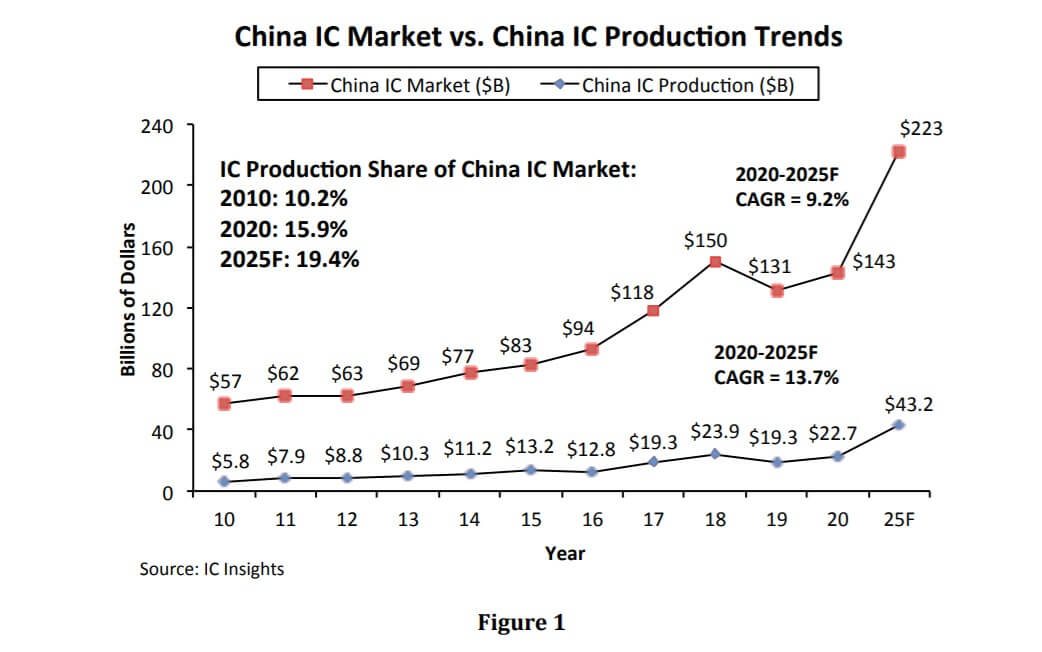

In 2020, China's semiconductor production accounted for 15.9% of its total US$143.4 billion market, which is higher than 2010, 10.2% 10 years ago. It is estimated that by 2025, this share will increase by 3.5% over 2020, reaching 19.4%. (The average annual growth is 0.7%), as shown in the figure 1.

IC Insights further analyzed that the total semiconductor manufacturing in China last year was US$22.7 billion, but local companies (the company is headquartered in mainland China) produced US$8.3 billion, accounting for 36.5% of the total, and only 5.9% of China’s total US$143.4 billion market. This also means that the remaining market share is occupied by TSMC, SK Hynix, Samsung, Intel, UMC and other companies with fabs in mainland China. IC Insights estimates that USD 2.3 billion of the USD 8.3 billion comes from IDM and USD 6 billion comes from foundries such as SMIC.