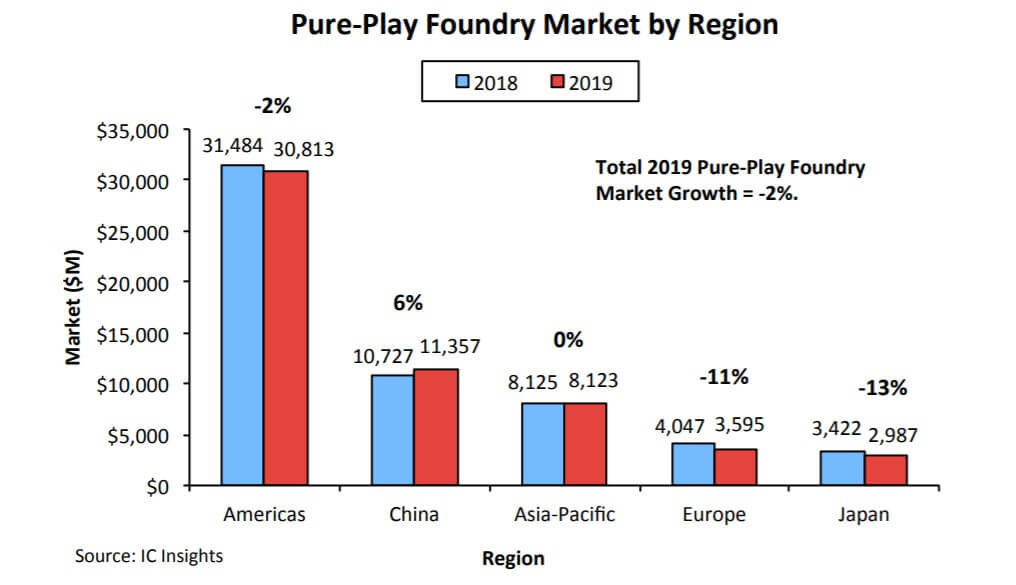

IC Insights recently released the performance report of the global wafer manufacturing market in 2019. According to the report, the mainland China market was the only region where pure wafer foundry sales increased last year.

The report states that in 2019, the size of China's wafer manufacturing market was 11.357 billion US dollars, an increase of 6% year-on-year; the Americas was 30.813 billion US dollars, a year-on-year decrease of 2%; the European region was 3.995 billion US dollars, a year-on-year decrease of 11%; USD 2.987 billion, down 13% year-on-year; Japan was 2.987 billion US dollars, a year-on-year decrease of 13%.

Compared with 2017, China's total share of the pure foundry market in 2018 rose by 5% to 19%, which is 5% higher than the rest of the Asia Pacific region. Mainland China accounted for almost the entire share of the pure wafer foundry market growth in 2018.

However, in 2019, the trade war has slowed China's economic growth, and the foundry market share in mainland China has only increased by 1%, accounting for 20%.

Overall, China's pure-play foundry sales increased by 42% in 2018 to $ 10.7 billion. In addition, in 2019, pure-play foundry sales in mainland China increased by 6%, which was 8% higher than the overall market decline of 2%.

In 2019, TSMC said that about 25% of its customers are located in mainland China. Both TSMC and UMC achieved sales growth of more than 10% in mainland China last year. UMC's sales increased by 19%, and its growth was driven by a 300mm 12X wafer fab in Xiamen, China, which opened at the end of 2016 and currently has a capacity of approximately 22.7K / month 300mm wafers.

Compared with UMC's growth, SMIC's sales in China in 2019 fell by 8%, while the company's total sales fell by 7% last year.